Are you feeling stuck in a rut with your insurance program funding? Too often, brokers offer only one solution – guaranteed cost. While this method may be straightforward, it’s often the most expensive way to transfer your risk. But what if I told you that there’s a better way?

At Kapnick, we believe in offering our clients more than just the standard option. We delve deep into your premiums, losses, and other data from the past 3-5 years. With this information in hand, we review your funding options and potential outcomes, exploring alternative strategies like:

- Deductible Plans

- Self-Insured Retention

- Group Captive

- Retrospective Plans

- Self-Funded solutions

The result? Our clients are able to take back control of their finances, reaping the benefits of increased financial security and significant cost savings, averaging at 20%.

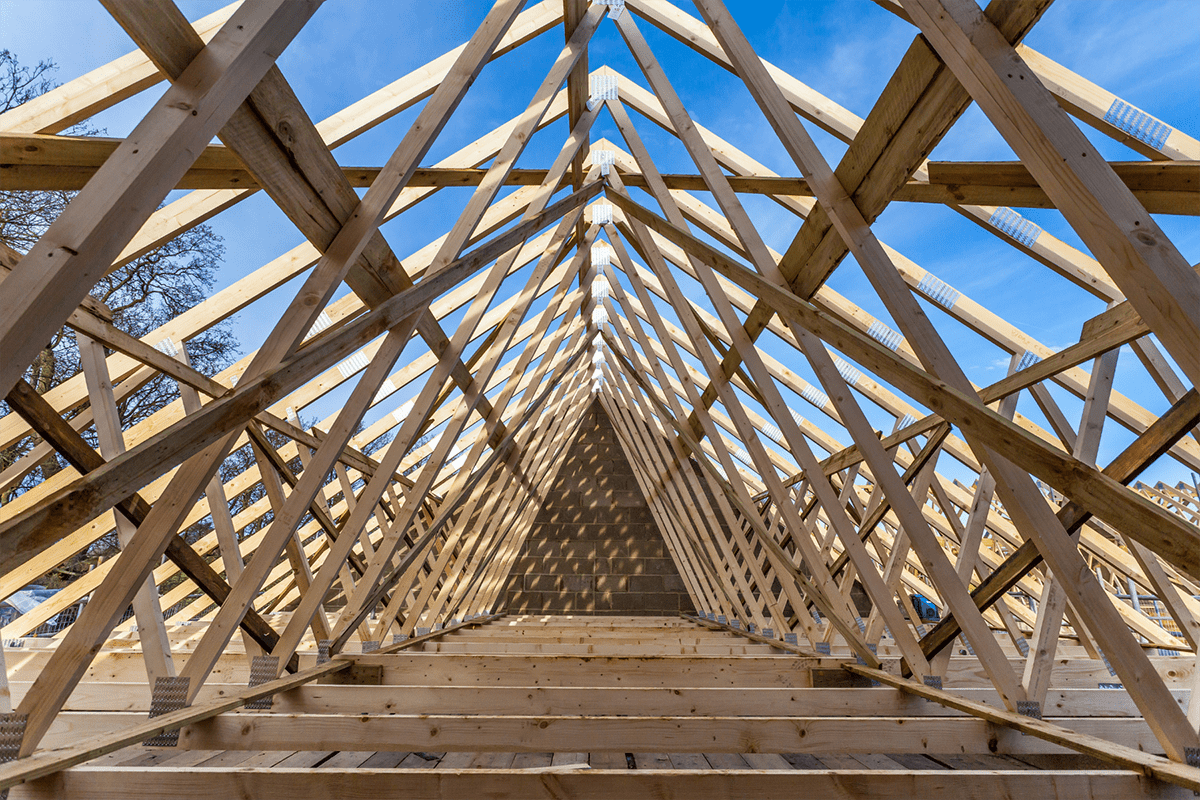

To illustrate, let’s take a look at a case study where our approach made a world of difference for a best-in-class contractor:

Case Study: A Kapnick client averaged $600,000 annually for their casualty insurance premiums, including contractor’s general liability, workers’ compensation, and auto. This best-in-class contractor averaged less than $100,000 in claims, yet despite their outstanding loss history and safety programs, and Kapnick’s aggressive marketing, they were unable to reduce their premium costs. They were already receiving the best premium available the fully insured marketplace was willing to offer.

Kapnick’s analysis showed that by pursuing an alternative risk program, they could reduce insurance costs by 50%. This has resulted in $300,000 in dividends annually back to the client.

Reach out to learn more about how to break free from the constraints of guaranteed cost programs and discover smarter, more efficient ways to fund your insurance program.