The cost of healthcare is rising every year–both in premiums as well as doctor visits and prescription drugs. One consumer-driven approach many organizations offer is a high deductible health plan (HDHP) partnered with a health savings account (HSA). This is a great alternative to a traditional health plan as it’s designed to empower you to take control of your health and the dollars you spend on your care both now and in the future.

An HSA-qualified health plan offers lower premiums, which means you’ll save more money each month. More importantly though, it allows you to open a health savings account.

4 advantages health savings account (HSAs) offer:

Tax Savings. You don’t pay taxes on the amount you contribute to or withdraw from your HSA, as long as you’re eligible to contribute to an HSA and you use HSA funds for qualified medical expenses.

Reduced out-of-pocket costs. You can use the money in your HSA to pay for eligible medical expenses and prescriptions. The HSA funds you use can help you satisfy your plan’s annual deductible.

Your funds are yours. Unused account dollars are yours to keep even if you retire or leave the company. Additionally, you can invest your HSA funds, so your available health care dollars can grow tax-free over time.

Automatic roll over. Unused HSA funds don’t expire or disappear, so whatever you don’t use this year is money you can use to reduce future out-of-pocket health expenses.

What is an HSA?

A Heath Savings Account is a personal savings account that works in conjunction with an HSA compatible health plan being offered by your employer. You can use your HSA to pay for current and future qualified expenses – tax free*.

BENEFIT FROM TAX SAVINGS

The money you contribute to your HSA is tax-deductible and can be used to pay for qualified medical expenses not only for yourself, but also for your spouse and tax dependents.*

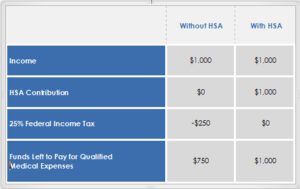

The chart below shows how you can benefit from tax savings when you contribute to an HSA.

FLEXIBLE ONLINE FUNDING

The maximum amount the IRS allows you to contribute to your HSA in 2023 is $3,850 for single and $7,750 for family coverage, plus catch-up contributions of $1,000 for those 55 and older – but you don’t have to contribute it as a lump sum. Check with your employer to see if you can contribute to your HSA through before-tax payroll deductions. Or you can make after tax, online contributions to your HSA up to the annual IRS contribution limits. It’s entirely up to you – but the more you contribute, the more you have available to pay for qualified medical expenses.

CONVENIENT PAYMENT OPTIONS

With a swipe of your HSA debit card, you can pay for prescriptions, doctor visits, dental expenses, and more. Funds will automatically be deducted from your HSA. Please contact your HSA administrator/ bank for more details.

INVESTMENT CHOICES TO MEET YOUR NEEDS

Once a minimum balance in your FDIC-insured deposit account is met, you have the option to invest additional contributions you make to your HSA. With a diverse array of fund offerings, it’s easy to find an option that matches your personal financial goals and investment style.

A SMART CHOICE

You can use the money you contribute to your HSA to pay for qualified medical expenses now, or you can save and build your balance to use later or in retirement – all tax free*.

Use it today. Want to pay for current healthcare expenses? Use your convenient HSA debit card or pay with cash for later reimbursement.

Save for retirement. Money in your HSA rolls over year to year, and you don’t have to pay taxes on the interest or investment income you accrue. That’s an important advantage to anyone saving for retirement. You won’t be taxed, even after you retire, as long as you use the money in your HSA for qualified medical expenses.

Read the full article here to learn more about how your HSA works with your doctor, pharmacy and other eligible expenses.

* Tax references are at the federal level. State taxes may vary. Please consult a tax advisor